Developing Earth Observation Solutions for Commercial, Government, and Military Users

A Recap of SmallSat Symposium 2024

Industry observers anticipate substantial transformations in the SmallSat market throughout 2024. The SmallSat Symposium provides a platform for industry professionals to deliberate and navigate the evolving landscape of the SmallSat market, especially in light of the projected changes expected in the year ahead.

During the 2024 SmallSat Symposium, Cognitive Space Founder and CEO, Guy de Carufel, had the pleasure of sharing industry insights on the panel discussion “Building EO Services for Commercial, Government, and Military Users”. Joined by fellow industry leaders and moderated by Maxime Puteaux, Space Industry Practice Leader of Euroconsult, the discussion explored the future trends and challenges in Earth Observation (EO) services, market dynamics, technological advancements, and the evolving landscape of EO applications across various sectors.

Here, we provide an overview of Guy’s contributions to the panel discussion and the questions posed during the event.

What strategies does Cognitive Space employ to manage the balance between standardization and diversity in customer requirements? Can you tell us more about Cognitive Space?

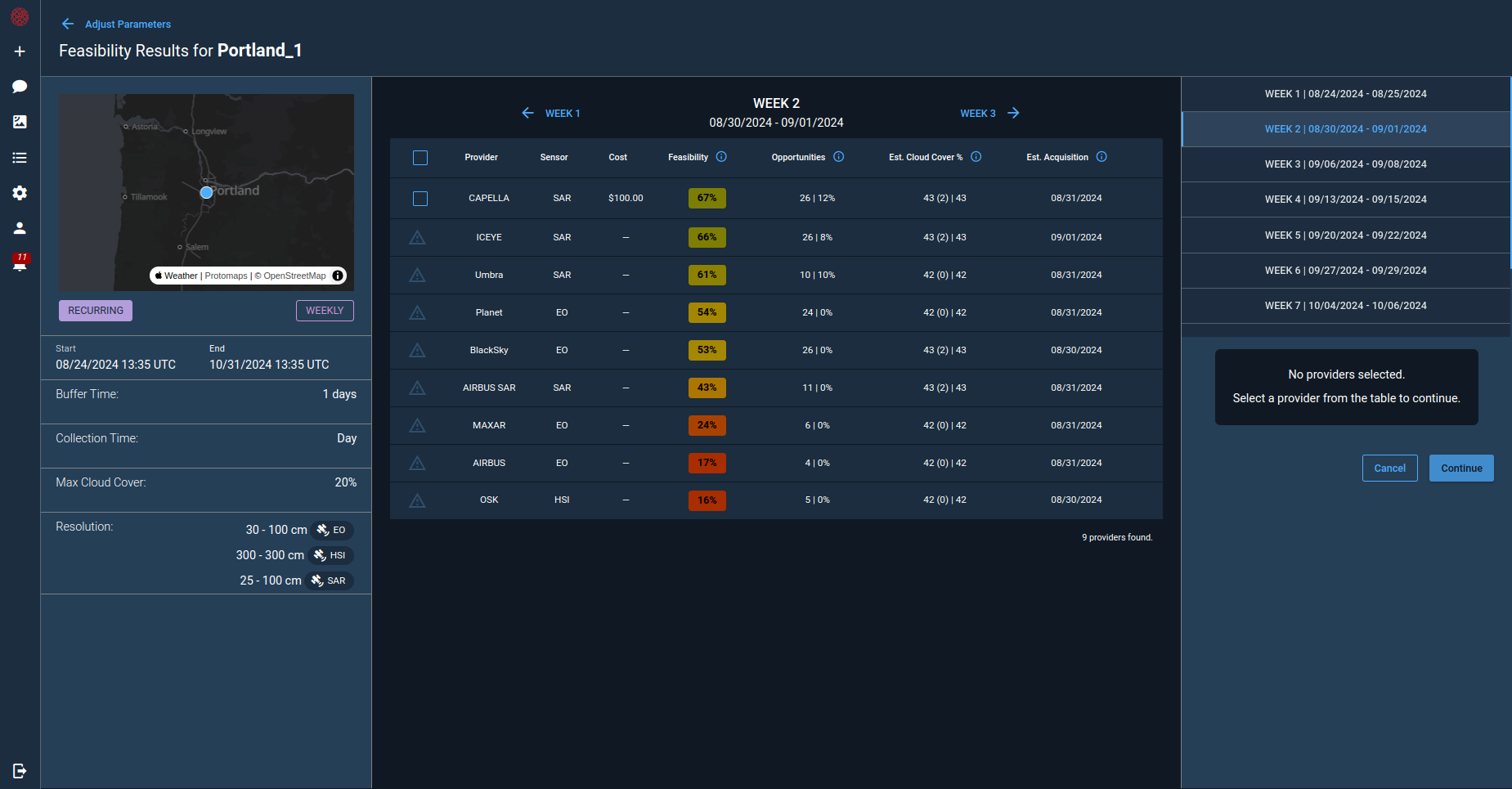

Cognitive Space is a US-based AI SaaS company that’s focused on empowering the use of space for earth observation to provide security, sustainability, and economic prosperity. We optimize asset management of constellations, enabling providers to access and manage their assets efficiently in response to downstream user requirements. In addition, we facilitate collaboration among data providers to ensure that the right data is delivered to meet specific user needs.

Regarding standardization, we recognize its limitations. For instance, while requesting data may appear similar across different end users, such as defense or commercial customers, variations exist based on the specific analytics objectives. Defense customers prioritize speed in acquiring data and insights, while commercial customers may prioritize different types of insights and have longer timeframes for data acquisition. In the end, you’re defining an area of interest and defining some requirements for quality control, the kind of sensor you want to use, etc.

How does interoperability ring through your ears as a SaaS provider?

When it comes to government systems, integration is particularly complex due to their often outdated infrastructure. These systems may not utilize modern API methods or restful APIs, which complicates the integration process. On the commercial side, challenges arise from the diversity of ground systems and satellite communication methods across providers. Each provider may have unique protocols and systems, making integration efforts variable and sometimes challenging.

In terms of integrating with providers for ordering processes, we’re seeing a gradual move toward standardization, but with nuances. Differences exist in how providers handle orders, changes, cancellations, and payment methods.

While standardization is increasing, and we’re starting to see more providers come online, there are still broad variations among providers. Today, any provider coming online must offer an API that supports communication, whether it’s through restful APIs, GraphQL, or other means. The ability to facilitate machine-to-machine communication is essential for relevance in the current landscape.

How do commercial Earth observation (EO) companies respond when governments offer comparable data at no cost?

In the US, the Geospatial Data Act mandates public sharing of data collected by government agencies, potentially impacting the commercial sale of imagery. However, even though government agencies like NOAA share weather data publicly, commercial EO companies find ways to add value by aggregating, analyzing, and interpreting the data for sale.

Additionally, recognizing the potential limitations of their satellite capacity, commercial EO companies acknowledge the value of government collaboration. Governments can supplement their data collection efforts with commercial sources to ensure comprehensive coverage, especially given the diverse sensor types and increasing number of satellites deployed. This partnership benefits both parties by providing enhanced data quality and coverage for various applications.

Is climate change, monitoring, and adaptation driving business at the moment?

The government is generally still the biggest buyer of space data, primarily for defense and intelligence purposes. However, there’s a shift occurring as sustainability becomes a global priority. Governments worldwide are increasingly investing in insights derived from space data to address sustainability challenges. While this trend is still in its infancy, it’s growing steadily due to the growing demand for such insights.

To what extent does reliance on US government contracts factor into your overall operations currently?

Currently, the majority of our business relies on US government contracts. Given that the US government is the largest purchaser of space data, either directly or indirectly, they constitute our primary customer base. While this provides stability and funding for companies in the market, it also poses challenges for broader industry access to satellite capacity. As new companies enter the market and open up new opportunities, we anticipate seeing increased capacity beyond government contracts.

The shift towards mass markets accessing imagery and procuring data from multiple providers will change how earth observation is utilized across various sectors. Ultimately, we hope to reach a point where we can reduce our dependence on the US government and establish partnerships with commercial end users of space data to diversify our customer base and expand opportunities within the industry.

Should efforts be made to aggregate data from multiple EO companies?

The aggregation of data from various companies holds significant importance beyond just addressing limited capacity concerns. It’s crucial because the capacity is utilized by diverse customers, including the intelligence community, which might preempt data availability.

Having multiple options to pull data from various providers and sensor types enables us to answer specific questions effectively. Access to different sensor types provides a multi-dimensional view of events, which is essential for the market’s advancement and growth.

Do you think 24/7 earth observation services will be coming in the near future?

Not global coverage, but a constant stare, yes.

Contact Cognitive Space to automate your satellite operations.